Yes, I have not written for a while,

but one question was disturbing me for quite a long time now. Especially after looking

at few software solutions for Activity Based Costing. Some of them are now

called Profitability and Cost Management solution. The question is, do we need

to have structural compartments (aka Modules) like ‘resource’, ‘activity’ and ‘cost

objects’ in those solutions? I understand that all those solutions have been

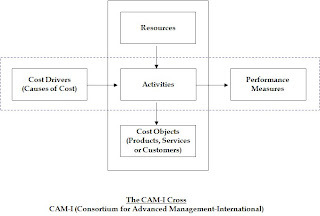

designed quite a few years back and they are mostly based on the CAM-I cross.

The CAM-I cross told us that the

vertical flow is the cost flow and it flows from resources to activities to

cost objects. Cost objects are the final destination points for which we

calculate costs for. As such the Activity Based Costing requires three phases

as resources, activities and cost objects. All the software solutions based on

this concept created in there solutions three modules as the same. Also the diagram

also shows that the cost flows from resource to activity and activity to cost

objects. Again the solutions had assignments that can have cost flow like

resource-activity, activity-cost object or resource-cost object. Some of the

solutions have resource-resource, activity-activity or cost object-cost object assignment

(intra-module) facility. Almost none (actually I wanted to write ‘none’ here,

but I cannot claim that I have seen all the solutions) of the solutions have

cost assignment possible (directly) from activity-resource or cost object-activity

or cost object-resource. Where ever it is possible, one has to create some work

around to handle this.

I certainly do not want to say

all this is bad. But it was based on the concepts and methodologies adopted at

that time. It is more than 20 years that the concept has been around. We have seen

many changes in the Body of knowledge, implementation methods, uses and

software solutions in those years. Few things still remain as they were earlier

like

1) The

solutions are having resource, activity and cost object as structural

divisions.

2) The

follow up of this is, assignment are not possible in the reverse order (as direct

functionality)

Scenario

Let us take one example of

distributing the cost of ‘shared service functions’. These functions like HR,

Admin or IT provide services all other functions in the organization. To

distribute their cost based on the ‘cause-and-effect’ relationship, we create

following steps

a) Define

the services provided by those function. For example recruit people, manage

hotel booking, manage software solutions.

b) Calculate

the cost of each of these services

c) Assign

cost of those services based on the volume of the services consumed by each of

the other functions

d) This

cost is as good as the other expenses (like employee cost, travel cost etc.) of

the functions

This scenario cannot be created as

it is defined here as a direct functionality.

Some of the

software solutions where one can create intra module assignments, here is one

of the ways

i)

Enter cost of the shared services in the

resource section

ii)

Define the services of the shares service

function in the resource section. Actually they are processes or activities.

iii)

Calculate the unit cost of services. Resource-resource

assignment.

iv)

Assign those services cost to other functions

resource-resource assignment

Some solution

that do not have resource-resource assignment facility, but activity-activity assignment

facility

i)

Enter cost of shared service function in

resource section

ii)

Define services of shared service function in

Activity section.

iii)

Calculate the cost of the services

iv)

Assign those services to the activities of other

function that are consuming those services. Activity-activity assignment

Similarly the cost of Procurement

department has to be calculated as vendor wise-material wise and then takes as

additional cost of the material. This scenario will also require a big juggling

in creating the model in the solutions.

The absence of the other functionality

that of flowing cost in the reverse way i.e. cost-object-activity,

activity-resource (as a direct functionality) is creating a challenge. This is

especially when one has to create the ‘bottom-up’ model or Activity Based

Budgeting/Planning (ABB/P) model.

Activity based costing is based

on the concept of ‘cause-and-effect’ relationship. As such there should not be

any restriction on what is a source and destination. Actually I am suggesting

that there should not be a rigid concept of ‘resource-activity-cost object’.

All these sections should be logical. User should be able to create as many

sections as she wants and call them whatever she wants to. Once this

restriction goes then we call the solution as ‘Cause and Effect

Profitability Management Solution’.

This type solution can be used

for single level assignment of costs or multilevel assignment (2, 3 or even more).

One need not worry about the concept of whether it is resource or activity or

cost object. Just select ‘source’ and ‘destination’, link them, add driver and

driver quantities and calculate.

I have called this solution as

Profitability Management solution (not only cost) purposely. Profit is a

function of Revenue and Cost. Most of the solutions are built upon the concept

of cost assignment. What I mean is, those solutions allow us to create a flow

of cost. Revenue is directly entered against product-customer-channel

combination and profitability is calculated. This was based on the concept that

is related to manufacturing industry In the Telecom industry the revenue is

bundled for many services that are used by the consumer it is very difficult to

create a profitability scenario. A lot of free services (completely or

partially) are also included. There is also volume based revenue for certain

services. If we try to use the usual functionality of the software solutions,

it is very difficult to create this scenario. So the solutions should have the functionality

of calculating multiple measures (cost, revenue, discount etc.) based on ‘cause-and-effect’

relationship to calculate profitability at the end.

The flow of measures is based on ‘cause-and-effect’

and it contains the functionality to flow the information for all the measures

that contribute to Profit. Hence the solution should be ‘Cause and Effect

Profitability Management Solution’

The benefits this type of

solution is full flexibility of modeling for profitability. It could be single

level or multi-level. We can calculate standard costs (multi-level calculation)

and then compare with actual. More than the usual variances of quantity, rate,

mix etc. can be available. We will be able to use the same solution for Revenue

planning and it can become a real Profitability Management solution as it can

plan and get actuals to analyze the variances in Revenue, cost and hence,

profit.

Please

provide your comments or suggestions on this concept of the solution. I have

not seen all the software solutions in their current forms, so some of the

functionalities may be already available. Is there a solution already in the

market which can be called as ‘Cause and Effect Profitability Solution’?

Rajenda - I agree with much of what you say with regard to strict definitions of modules which represent a specific CAM-I ABC view of life as opposed to a broader, cause-and-effect approach.

ReplyDeleteEnabling reverse cost flow is a terrible idea in my opinion, simply for the reason that the system complexity, potential for double-counting and eventual lack of transparency will outweigh the benefit. For ABB purposes you need quantitative driver information to "flow" backwards, calculate demand on resources and then flow costs forwards.

I agree that flowing multiple measures can be useful.

I can speak with experience as a reseller of SAS Activity-Based Management software that some of these issues are addressed through this software, though not always obviously. Multiple reallocation stages through modules (as many as you like) and the ability to describe stages through which to analyze contributions are supported. Reverse cost flow is not supported but the ABB methodology is supported through native functionality.

At a practical level, I have modelled revenue using the "Cost" system property in a different scenario and automated the combination of cost and revenue into the same period/scenario (as you say, Telcos is the main application here). I have also flowed asset values (useful in regulatory modelling) and others such as FTEs. I have also designed shared service models where the cost objects are the resource inputs for operational business units. This process can also be automated relatively easily.

On a general note, after 13 years of designing and implementing cost models, I believe that the way forward lies in simplicity. What is gained in additional accuracy through multiple layers of cost allocation and reciprocal assignments is often lost in the lack of transparency in contribution reporting.

In the interests of full disclosure, my company has also developed a desktop product, Cost & Profitability Analyzer which supports 5 stages of cost flow and is designed to bridge the gap between MS Excel and the enterprise-level systems such as SAS ABM.

Hi Rajen,

ReplyDeleteIn SAP PCM it's possible to reassign activity costs back to cost centers, like you would reassign IT services to operational departments. The target departments can in turn push these indirect costs to their own activities. In effect, this is the way the standard activity reassignment feature works.

It is also possible to use cost object costs as resources by using the cross-model feature.

Regards

Jérémie

Good, nice one.

ReplyDeleteQuite elaborate.

Regards,

Anuj Agarwal

Raj,

ReplyDeleteWhen I was building models in the early 90's, i got over the limitation of Resources, Activity and Cost Object modules by simply ignoring the module names and using then for whatever purpose I wanted. I also created multiple levels within each module. This way I could model the flow of cost within the business enterprise correctly.

New software offerings today offer an open module architecture. CostPerform, which I use does this exceptionally well. Still the skill of the practitioner in designing the model solution is paramount, and most of the practitioners out there have absolutely no idea how to design models. I have seen literally hundreds of models within the newer software offerings that still subscribe to the prosaic CAM-I cross view of the world. I have heard it said that 90% of ABC implementations fail to live up to their promise, and I do have to agree with that, and lay the blame squarely on bad design and unskilled practitioners.

That's why I prefer OFSAA PM solution for ABC tool for FSI industry. Actually we have many FSI customers using OFSA PA or OFSAA PM for ABC solution. OFSAA PM doesn't have concepts on ABC within the system but it has flexibility to define any revenue/cost flows. And no limit for revenue/cost object. Revenue/Cost can be allocation even to transaction level of customer account.

ReplyDeleteDear All

ReplyDeleteForgive me if I have not myself clear, but I wish to talk here about Profitability Management. This is based on 'cause-and-effect' logic.

If we again go the route of ABC it will fail again. The solution should provide facility to create single level or multilevel flow of measures (cost, revenue, discount etc.)

Dear Rajendra,

ReplyDeleteGood work. Keep it up.

Anil Agrawal

Rajen,

ReplyDeleteI was missing your blogs for quite a while and I'm happy to see you posting again.

With RapidBusinessModeling one is completely free to model exactly the way you want and described. If you want, I invite you for an online meeting and you can turn your description into a multidimensional business model using cause-and-effect relationships.

There are no restriction on anything besides competence and knowledge of the subject matter Activity Based Costing of any kind and the knowledge to build what we call a business model.

The building takes place on the FlowBuilder where you can make any model by going through baby steps. One typical step will be to go from accumulated resource costs via the appropriate driver and assign those buckets of costs onto the people in the department and location. If you have costs which should be assigned to the final cost object like customer sampling costs, then you can take those costs and assigns them in one piece to the various steps until you'll decompose it to the final cost object like customer or product or whatever.

Once you have finished this FlowBuilder one can make a function of this, give it a catchy function name and one is ready to re-run this function just based on their input tables like xls/ xlsx or CSV files which of course could be used for a completely different organization with different names with different dimensions as long as the underlying process stays the same.

The combination of those functions can be combined to one new function combining the whole process or the whole model.

Whatever one can have a handle on something you make a variable. That way you turn the process into one hybrid symbolic numeric business model ready for simulation!

If you like here's a 5 min. Video showing an example.

http://youtu.be/RgXrymyytEQ

Have a nice day

Cheers

Hans

Hans-Gerlach Woudboer

CEO&Founder

RapidBusinessModeling

+49 160 530 1809

http://xeeMe.com/HansGerlachWoudboer/

(My Business and Social presence)

Rajen and others,

ReplyDeleteI agree with your article. I like the comment about ignoring the Resource / Activity / Cost Object boundaries. ABC is in effect a cost re-assignment network with many "multi-stages.

Several software packages are mentioned in the comments, so I will add the one from my employer, SAS ABM. It was originally Oros from 1988 by ABC Technologies that SAS acquired 10 years ago. With almost 25 years, it can model all of the relationships in your article, and even more when you include "tagging" with attributes (e.g., level of value-add, level of performance, cost of quality categories, etc.

You are a good writer .. and friend, Rajen.

Gary ... Gary Cokins, SAS

I see the value of the CAM-I cross mostly as a unifying educational model to shape people's thinking about ABM as a general approach. While initial tools may have rather rigid resource-activity-cost object distinctions and levels, modern tools provide more flexibility either through metadata (SAS "tagging" mechanism) or lack of rigid structural conventions (RapidBusinessModeling).

ReplyDelete"Profit is a function of Revenue and Cost. Most of the solutions are built upon the concept of cost assignment."

Your observation is correct. Tools should allow flexible forms of revenue assignments as well. In fact, a tool like RapidBusinessModeling allows to model the flow of any measure, whether it be money, energy, materials or any other distributable quantity. One can even imagine less tangible quantities such as social media attention or influence, even though the cause-effect relationships may be less obvious in those cases. Under the covers, the tool just does the math - here a derivative of multi-dimensional tensor-algebra - and is oblivious to what the numbers mean.

The latter is where the knowledge of the modeler comes in. As Anil rightly points out, many models fail not due to limitations in the tool, but due to inexperience of the human modeler. Today's tools have no way of scoring the validity of a model, hence they won't stop you from producing non-sensical flows (i.e. ones without true cause-effect relationships).

Lastly, our experience with RapidBusinessModeling is not so much the limitations of the tool, but the understanding and buy-in of human decision makers. While the individual elements of a flow-network model are not rocket science, the multi-dimensionality and sheer number of detailed calculations are not intuitive either. Hence reactions range from disbelief - "... that fine-grained profitability picture can't possibly be correct..." - to complexity rejection - "...this is all way too complex for what my business needs...". I think the best cure is a lean development approach, with simple initial models, multiple small iterative steps that produce tangible results, adding more dimensions or granularity as needed.

Regards,

Thomas Laussermair.

Hi all,

ReplyDeleteThanks for the tips. Usually, I do not post on blogs, but I wish to say that this post really forced me to do so! Thanks, incredibly nice article. Thank you lots, I am obliged to announce that your blog is excellent!

Yard Management solutions

Wonderful article, very useful and well explanation. Your post is extremely incredible. I will refer this to my friends

ReplyDeleteLoadrunner Training in Chennai

Looking for Best Payroll Services? ALP consulting offers effective payroll services like...

ReplyDeletePayroll Services ,

Payroll Services , HRMS Payroll Software

Well written article. Get rid of the traditional ways of marketing and buy a customized email list from us. One real-time data can change your entire business for good. Parana Impact provides you the Email List that you are exactly looking for.

ReplyDeleteWe have worked with many organizations of all the sizes. Our main focus is customer satisfaction. Hospital Management Consulting Users Email List

Anchor Green tea is an excellent combination of 10 superb herbs & naturals including Terminalia Arjuna, Cardamom, Green Tea, Cinnamon, Senna Leaves, Aniseed

ReplyDeletefire alarm system

hearing aid Pakistan

hearing aids in lahore

custom suits

best seo company in lahore

calcium carbonate manufacturers

chocolate tea in pakistan

hearing clinic in lahore

Termite Treatment in lahore